Adolescent Medicine 4: Hot Topics

Session: Adolescent Medicine 4: Hot Topics

132 - Utility of the Transition Readiness Assessment Questionnaire in identifying financial readiness in youth with chronic illness

Monday, April 28, 2025

7:00am - 9:15am HST

Publication Number: 132.7111

Timothy J. Tuso, Santa Barbara Cottage Hospital, Santa Barbara, CA, United States; Maria Demma Cabral, Cottage Children's Medical Center, Santa Barbara, CA, United States; Pantea Rahimian, Cottage Children's Medical Center, Santa Barbara, CA, United States

Timothy J. Tuso, MD (he/him/his)

Pediatric Resident

Santa Barbara Cottage Hospital

Santa Barbara, California, United States

Presenting Author(s)

Background: The transition from pediatric to adult healthcare is crucial for adolescents and young adults (AYA) with chronic conditions, requiring self-management skills. The Transition Readiness Assessment Questionnaire (TRAQ) is widely used to measure readiness in areas like medication management and appointment scheduling but often overlooks financial literacy, essential for navigating healthcare costs and insurance. Lacking financial knowledge increases risks of treatment non-adherence and missed appointments due to cost, leading to long-term health issues. Although financial preparedness is vital, few readiness tools assess it. In our pediatric multispecialty clinic, we use an older TRAQ version that includes questions on financial readiness.

Objective: To evaluate the utility of the TRAQ in identifying financial literacy among AYA with chronic illness. Older AYAs will demonstrate higher scores reflecting advanced stage of financial readiness.

Design/Methods: This IRB-exempt, single-site retrospective chart review analyzed data from patient visits for individuals aged 14 to 20 years who were seen at our pediatric multispecialty clinic between January 1, 2019 and June 30, 2024 and had completed the TRAQ. Demographic information was collected and seven items related specifically to financial readiness were analyzed. A two-sample proportion test using the chi-square (𝜒²) test was conducted to determine if a statistically significant difference existed between the proportions of the 14–17 age group and 18–20 age groups in identifying level of financial readiness.

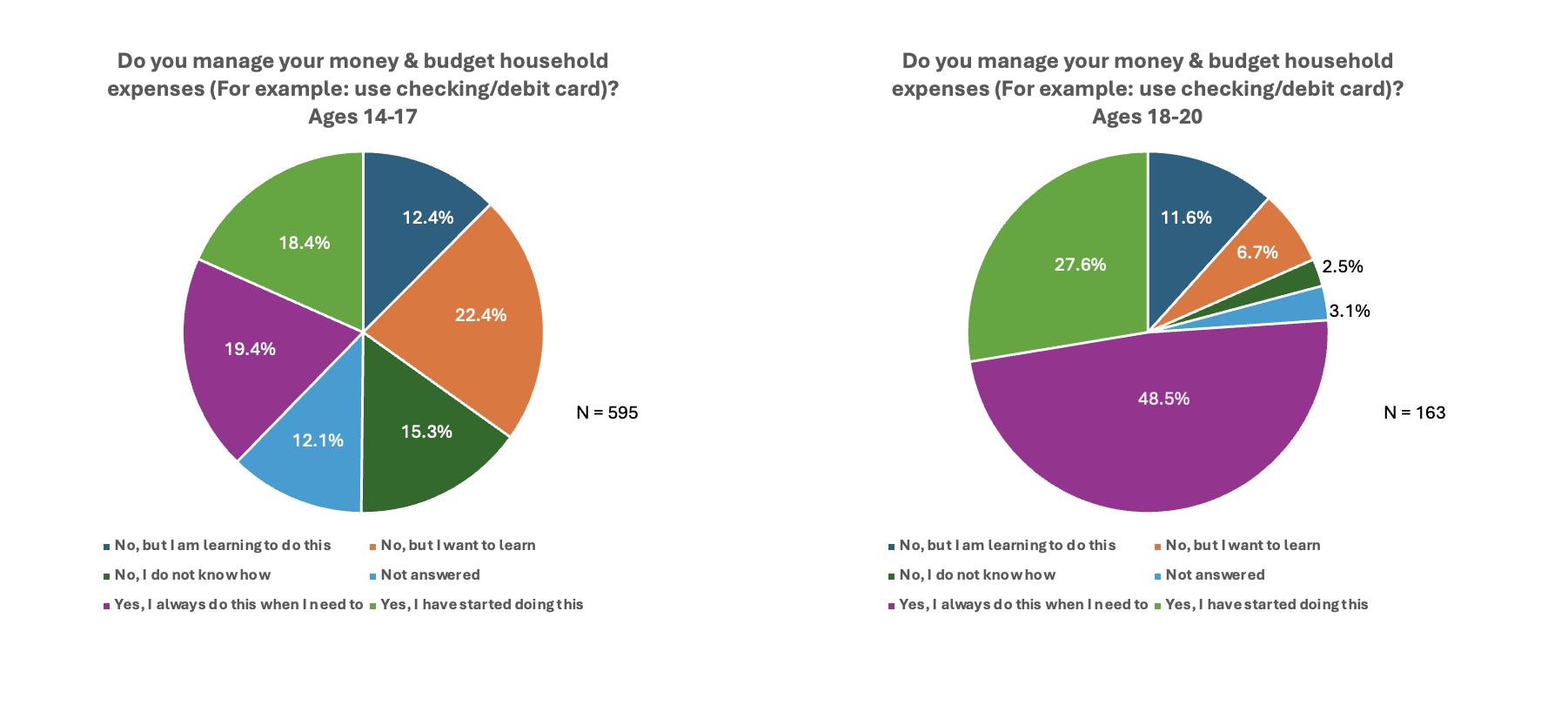

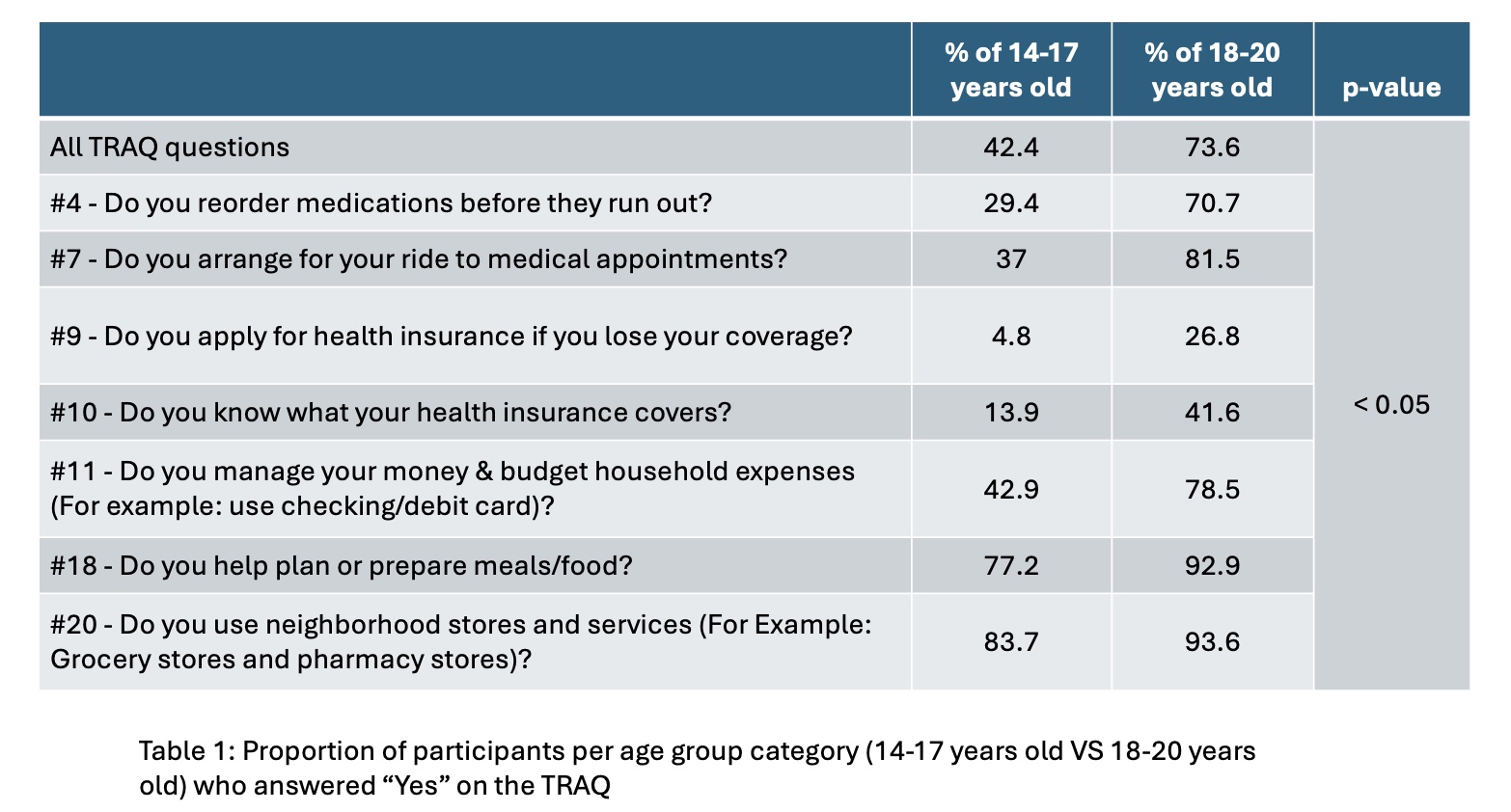

Results: Total of 14,404 TRAQ were completed. 57% of respondents were females. Two-thirds belong to the 14-17 year old group. The top 3 diagnoses were Crohn’s, Lupus and Diabetes. Figure 1 shows the TRAQ version used at our clinic. Table 1 shows the proportion of participants who answered “Yes” on the TRAQ survey. Across all questions, the proportion was statistically significantly lower in the 14–17 age group (42.4%) compared to the 18–20 age group (73.6%) (p < 0.05). When looking at the 7 items related specifically to financial readiness, similar statistical observation was shown implying that the older age group report more financial readiness. Figure 2 represents the graphical comparison between the two groups looking at 1 of the 7 items relating to financial readiness.

Conclusion(s): The TRAQ is a valid screening tool to initiate conversations with AYA about transitioning to adulthood and setting financial literacy goals, though it may need modifications or supplements to fully assess financial readiness.

Timothy Tuso CV

Tuso CV copy.pdf

Table 1: Proportion of participants per age group category (14-17 years old VS 18-20 years old) who answered “YES” on the TRAQ

Figure 2: Graphical comparison of the two groups looking at one of the seven items relating to financial readiness