Health Equity/Social Determinants of Health 6

Session: Health Equity/Social Determinants of Health 6

722 - Association Between Tax Policy and the Child Opportunity Index in the United States

Sunday, April 27, 2025

8:30am - 10:45am HST

Publication Number: 722.3590

Jean A. Junior, Ann & Robert H. Lurie Children's Hospital of Chicago, Troy, MI, United States; Jennifer Hoffmann, Northwestern University, Ann & Robert H. Lurie Children's Hospital of Chicago, Chicago, IL, United States; Doug Lorenz, University of Louisville, Louisville, KY, United States; Amanda Stewart, Children's National Health System, Washington, DC, United States; Michelle Macy, Ann & Robert H. Lurie Children's Hospital of Chicago, Chicago, IL, United States

Jean A. Junior, MD MPhil (she/her/hers)

Pediatric Emergency Medicine Attending

Ann & Robert H. Lurie Children's Hospital of Chicago, United States

Presenting Author(s)

Background: The Child Opportunity Index (COI) is a measure of neighborhood-level attributes that influence child wellbeing. It is associated with numerous child health outcomes. It is also associated with redlining, a practice starting in the 1930s that graded communities with higher proportions of Black and immigrant residents as less creditworthy, thereby contributing to decades of disinvestment. Tax revenues contribute to neighborhood characteristics that are sub-components of the COI (eg, school quality, green space availability, and health insurance coverage). Taxes may be progressive, requiring higher-income people to pay a higher proportion of their income, or regressive, which do the opposite. It is unknown whether tax policy influences the COI.

Objective: To examine the association between state-level tax policy and census tract-level COI across the US from 2008 through 2021.

Design/Methods: This is a cross-sectional study using tax data from the US Census Bureau and COI 3.0 z-scores from diversitydatakids.org. COI data were 5-year averages centered on midpoint years 2010-2019; positive values represent above-average opportunity. Independent variables were: (1) Total state and local tax revenue per capita, and (2) Percentage of tax revenue not comprised of sales taxes (a commonly used measure of tax progressivity). We examined the association between these 2 variables and census tract-level COI using a linear, multilevel, mixed effects model with year fixed effects, a random intercept for state, covariates for potential confounders, and a 1-year lag between tax policy and the COI. Sensitivity analyses included adjusting for census tract-level median household income (which is a sub-component of the COI) and redlining.

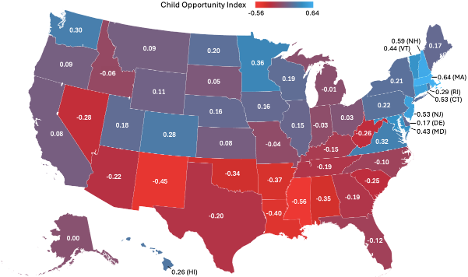

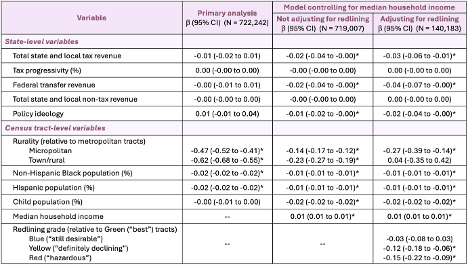

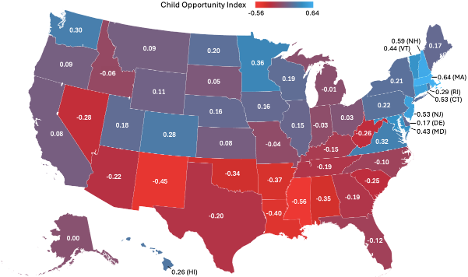

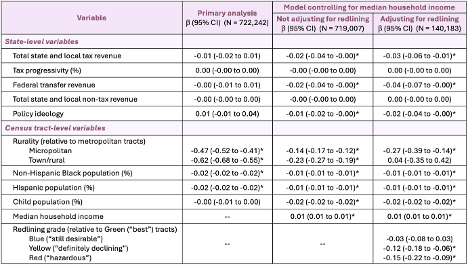

Results: We analyzed 722,242 census tract-years with COI z-scores ranging from -2.39 to 2.47 (Figure). There was no statistically significant association between tax revenue and the COI (b = -0.01; 95% CI -0.02 to 0.01) or between tax progressivity and the COI (b = 0.00; 95% CI -0.00 to 0.00). For every $1000 increase in census tract median household income, the COI z-score increased by 0.01 (95% CI 0.01 to 0.01); this association remained statistically significant after adjusting for redlining grade (Table).

Conclusion(s): State-level tax revenue and progressivity are not associated with census tract-level COI. Increased household incomes are associated with higher COI, thereby helping overcome legacies of redlining. Further research should evaluate whether household-level income supports, such as the earned income tax credit or child tax credit, can increase neighborhood-level child opportunity.

Figure: State-level child opportunity index z-scores

Each z-score is the weighted average of all census tract-years for each state for midpoint years 2010 through 2019. Each census tract-year represents 1 census tract with 5-year averaged COI centered on 1 midpoint year (eg, a census tract with COI data averaged for years 2008-2012 and thus centered on midpoint year 2010).

Each z-score is the weighted average of all census tract-years for each state for midpoint years 2010 through 2019. Each census tract-year represents 1 census tract with 5-year averaged COI centered on 1 midpoint year (eg, a census tract with COI data averaged for years 2008-2012 and thus centered on midpoint year 2010).Table: Multilevel, mixed effects, linear regression models assessing the association between tax policy and the COI

N = Census-tract years. All models include year dummy variables (not shown). All revenue and income variables are in thousands of 2023 US dollars. All revenue variables are per capita. Federal transfer revenue is revenue transferred from the federal government to state governments, which helps compensate for inadequacies in state tax revenues. Non-tax revenue includes fees (eg, state university tuition), fines (eg, traffic violations), and earnings from government investments. Policy ideology is defined with a mean of 0 and positive values representing more liberal ideologies. Labels assigned to redlining grades are those used by the federally funded Home Owners’ Loan Corporation in the 1930s. * p < 0.05.

N = Census-tract years. All models include year dummy variables (not shown). All revenue and income variables are in thousands of 2023 US dollars. All revenue variables are per capita. Federal transfer revenue is revenue transferred from the federal government to state governments, which helps compensate for inadequacies in state tax revenues. Non-tax revenue includes fees (eg, state university tuition), fines (eg, traffic violations), and earnings from government investments. Policy ideology is defined with a mean of 0 and positive values representing more liberal ideologies. Labels assigned to redlining grades are those used by the federally funded Home Owners’ Loan Corporation in the 1930s. * p < 0.05.Figure: State-level child opportunity index z-scores

Each z-score is the weighted average of all census tract-years for each state for midpoint years 2010 through 2019. Each census tract-year represents 1 census tract with 5-year averaged COI centered on 1 midpoint year (eg, a census tract with COI data averaged for years 2008-2012 and thus centered on midpoint year 2010).

Each z-score is the weighted average of all census tract-years for each state for midpoint years 2010 through 2019. Each census tract-year represents 1 census tract with 5-year averaged COI centered on 1 midpoint year (eg, a census tract with COI data averaged for years 2008-2012 and thus centered on midpoint year 2010).Table: Multilevel, mixed effects, linear regression models assessing the association between tax policy and the COI

N = Census-tract years. All models include year dummy variables (not shown). All revenue and income variables are in thousands of 2023 US dollars. All revenue variables are per capita. Federal transfer revenue is revenue transferred from the federal government to state governments, which helps compensate for inadequacies in state tax revenues. Non-tax revenue includes fees (eg, state university tuition), fines (eg, traffic violations), and earnings from government investments. Policy ideology is defined with a mean of 0 and positive values representing more liberal ideologies. Labels assigned to redlining grades are those used by the federally funded Home Owners’ Loan Corporation in the 1930s. * p < 0.05.

N = Census-tract years. All models include year dummy variables (not shown). All revenue and income variables are in thousands of 2023 US dollars. All revenue variables are per capita. Federal transfer revenue is revenue transferred from the federal government to state governments, which helps compensate for inadequacies in state tax revenues. Non-tax revenue includes fees (eg, state university tuition), fines (eg, traffic violations), and earnings from government investments. Policy ideology is defined with a mean of 0 and positive values representing more liberal ideologies. Labels assigned to redlining grades are those used by the federally funded Home Owners’ Loan Corporation in the 1930s. * p < 0.05.